E-commerce growth declined during Q2 2022

The second quarter continued the trend from the first quarter, with a fall of 8 percent. As society opened up again, consumption patterns in Sweden began to return to what they looked like before the pandemic.

One of the sectors where this is particularly evident is the grocery trade, which fell during the most recent quarter by 28 percent. This is because we are eating out more often and buying more of our groceries in actual stores again. Another sector that has been affected is sporting goods. The consumption of sporting goods has shifted from outdoor leisure products, which were popular last year, to equipment for team sports. Overall, however, sales decreased by 12 percent.

Other sectors are also starting to be more affected by the economic downturn. Both the furniture trade and the construction sector (building products) are connected to the shaky housing market and the credit terms for larger purchases that are linked to interest rate trends. Interest in the home has also cooled off somewhat as society has opened up, so it is natural that we are seeing a decline in the relevant sub-sectors.

On the other hand, pharmacy goods showed positive figures during Q1 and continued to be positive during Q2. It seems that the sector is retaining a lot of the customers it acquired during the pandemic and the market participants are doing a good job, with several pharmacies appearing on the list of consumers’ favorite online retailers in the E-barometern Q4 surveys.

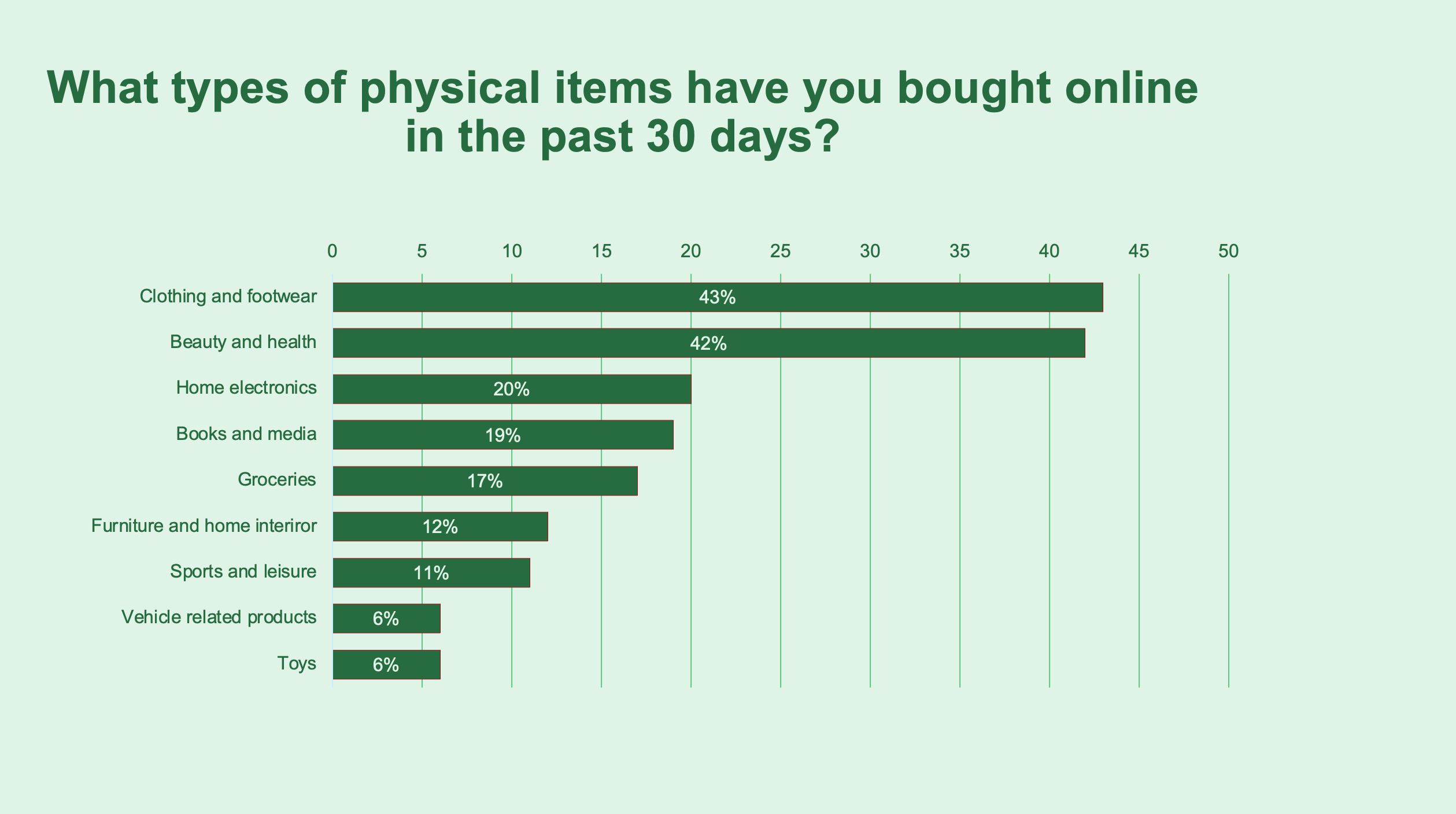

Fewer consumers have bought groceries and sporting goods

It was a tough spring for Swedish e-commerce. Basically all online shopping categories have had declining or negative growth measured in sales value. The fact that many consumers have returned to actual stores may be part of the explanation for this. Of the products consumers say they bought online, only beauty products have increased compared to last year.

The product groups that have grown the least include the grocery and sporting goods sectors. This illustrates not only that grocery shopping has decreased in terms of purchasing frequency or purchase amount (decrease in value), but also that some consumers seem to have stopped shopping for groceries online. The same applies to sporting goods, but as these are bought less often than groceries, there may be other explanations as well. For example, it is conceivable that the outdoor segment is now somewhat saturated after last year’s staycations.

Economic uncertainty affecting e-commerce

The economic situation is uncertain and there are several clouds on the horizon. Inflation is currently running at 8 percent and interest rates will most certainly rise further. This will affect consumer spending, as purchasing power decreases when loan costs increase and the conditions for new credit consumption deteriorate.

Another cloud on the horizon is the high energy prices, which have become even more of an issue in the wake of the crisis in Ukraine. These risk affecting both household purchasing power and retailer costs. There is also a risk that important export markets particularly dependent on Russian gas supplies will be hard hit. Germany, a market to which many Swedish e-commerce operators are exposed, is perhaps the prime example in this regard.

On the plus side among the otherwise gloomy news, it can be noted that global container prices are falling. Many of the problems that arose during the pandemic still remain, but it is nevertheless positive that the work being done to remedy the situation is beginning to yield results. If we start to achieve more well-functioning global trade again after all the pandemic-related problems, this could help keep commodity prices down and benefit consumption.

Source: The E-barometern Q2 2022