Extreme growth in e-commerce in 2020 when the sector grew by SEK 35 billion

The year 2020 was when the digital world seriously began to replace the physical world.

Cinema visits were exchanged for Netflix, coffee breaks for Facebook and physical commerce for e-commerce. E-commerce performed exceptionally well during the year, and the dream milestone of SEK 100 billion in e-com-merce sales was suddenly in sight. When all the sales figures had been added up, growth for the full year ended up at 40 percent for 2020, with total sales of SEK 122 billion. The increase alone (SEK 35 billion) corresponds to the entire turn- over for e-commerce in Sweden in 2012.

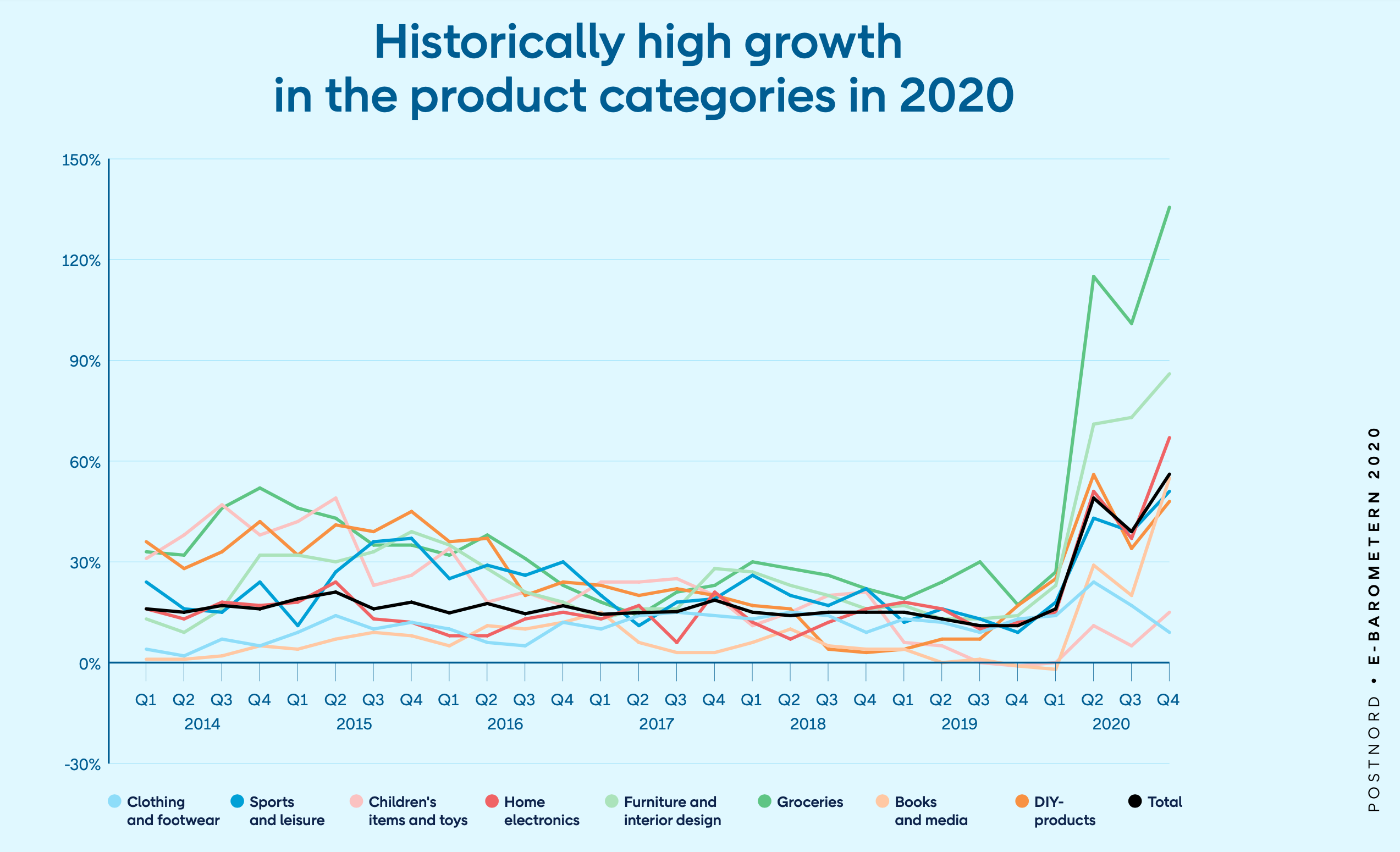

The growth in some of the product categories was even more dramatic. Grocery retail, which has long been the black sheep in an e-commerce context, completely exploded during the year. Almost 70 percent of all growth in groceries in Sweden took place online this year. As we illustrate later in the report, a considerable part of this is click and collect via the existing store network – a solution that the market participants have been good at scaling up during the pandemic.

Durable goods retail is, if possible, even more extreme. E-commerce grew by just over SEK 28 billion, while in-store retail fell by around SEK 14 billion. This means that physical retail declined in several sectors. This is especially true of fashion retail, which has had a very tough year. Downtown areas and malls that usually have a large number of visitors have also had significant problems in many places.

When we look ahead to 2021, a very difficult task awaits us of trying to assess how much of this e-commerce will become a permanent fixture and what the effects will be when Swedish society begins to return to the new normal. However, it is likely that the enormously high comparative figures established in 2020 will hold back the growth rate during the second half of 2021. The forecast for 2021 is a growth rate of 7 percent for the full year, which means e-commerce sales totaling SEK 130 billion.

How the product categories performed

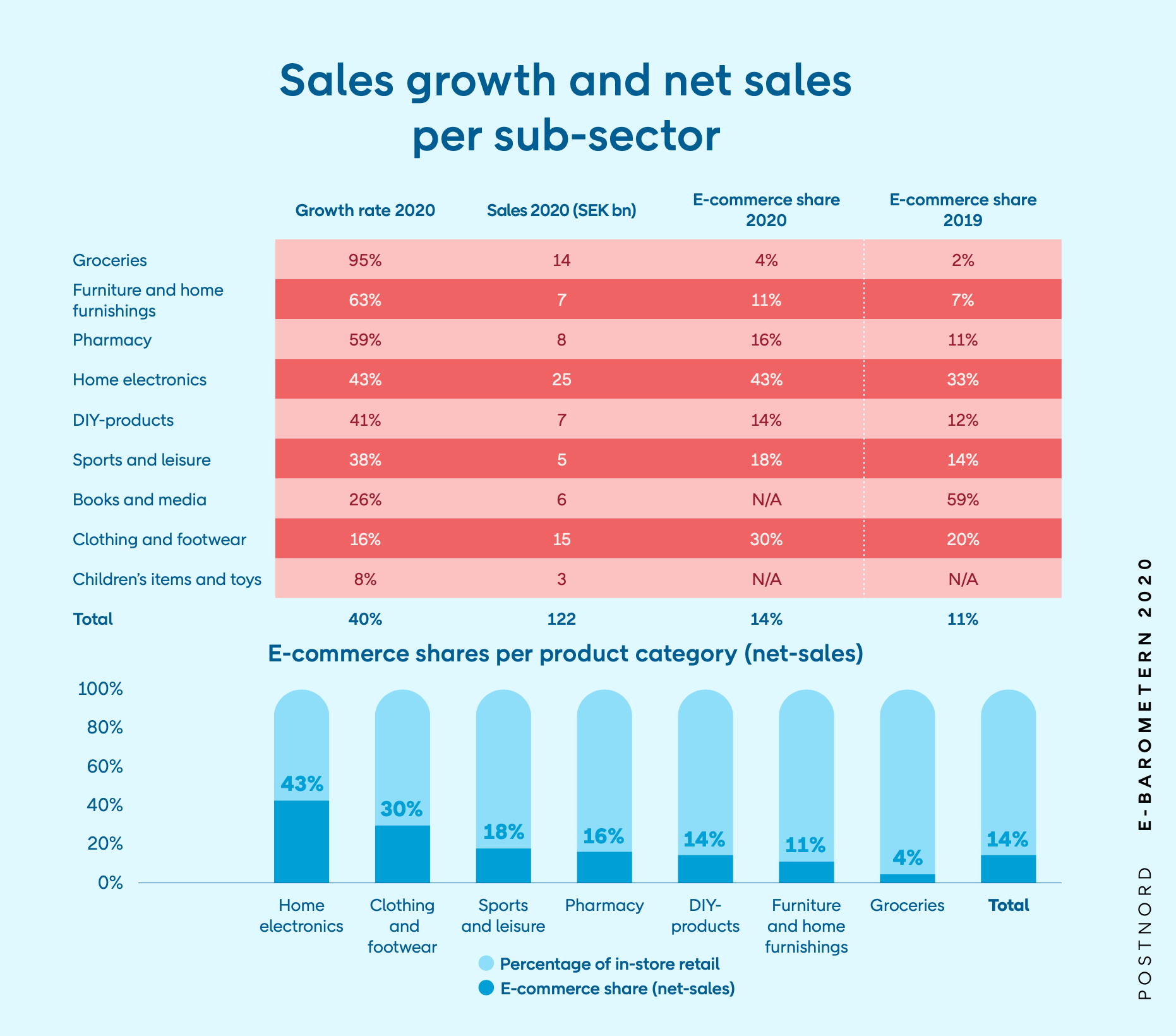

Just like for total e-commerce, growth records have been broken among the product categories. Fashion retail’s stable e-commerce growth, in combination with the catastrophic results on the store side, has caused the e-commerce share to shoot up from 20 percent last year to 30 percent this year. If this trend persists, it is uncertain how much of the physical retail will return. Among the respondents, the attitude towards the stores is divided. Some miss walking around shops, others do not.

Home electronics retail, which is another of the more mature sectors online, went through its baptism of fire a number of years ago. Despite the fact that a significant proportion of sales already takes place online, the subsector grew by just over 40 percent to an e-commerce share of 43 percent in 2020.

The strongest trend during the year was seen in grocery retail, but pharmacy retail, furniture and interior design also showed impressive growth figures.

Furniture and interior design experienced a sharp increase in e-commerce share, reaching 11 percent during the year, and this is starting to become a sector with a powerful online presence – which has not always been the case historically.

Overall, e-commerce market shares have shifted upwards by a number of percentage points, and many sectors are starting to move into the range of around 15–20 percent, which is where competition from e-commerce sales has historically begun to become very noticeable for the established market participants on the store side, resulting in changes and adjustments to store networks.

In conclusion, it can be said that most sectors have taken a step forward online in 2020 corresponding to at least three years of normal growth. The least digitalized sectors, such as grocery retail, have grown the fastest, but the more mature sectors have also managed to achieve impressive growth figures in several places.

Source: The E-barometern annual report 2020