E-barometer 2023 annual report

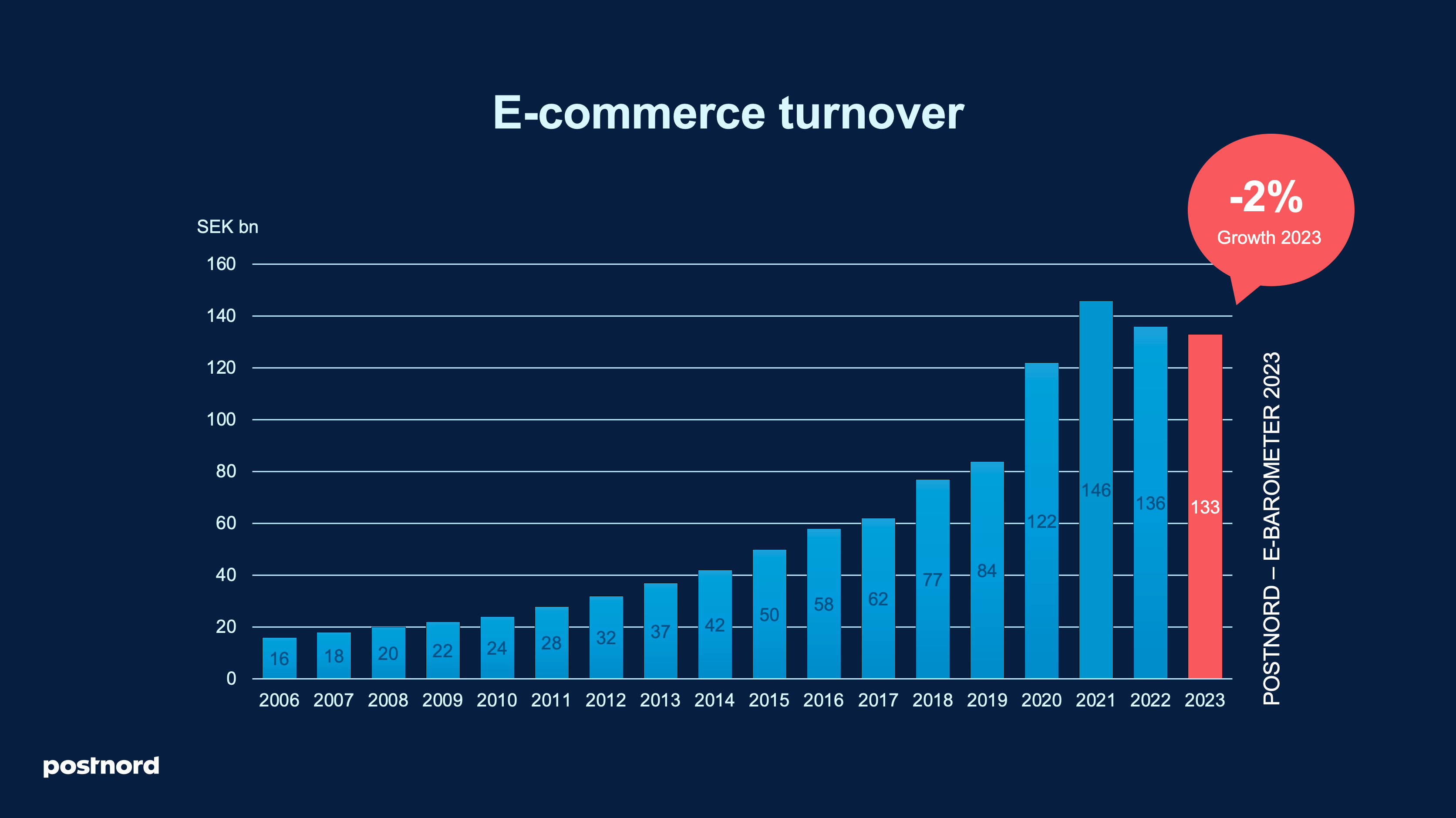

In the second occurrence of negative growth in E-barometer history, e-commerce experienced a slight decline, with a full-year development landing at minus 2% in 2023. While brighter than the 2022 decline of 7%, it still indicates a challenging year for online commerce.

That being said, significant disparities exist between industries. The gaps between capital-intensive and low-cost industries, e-commerce-friendly and cumbersome goods, as well as pleasure-driven and needs-based purchases, are widening.

2023 started off with significant challenges, but towards the end of the year, signs of improvement began to emerge. Both the E-barometer's development figures and the economic conditions indicate a slight easing in certain areas, a welcomed relief for both consumers and e-tailers.

Consumers are exhibiting increasingly sophisticated e-commerce behavior in response to the economic climate. Online platforms allow for research, comparison, and price evaluation, activities that many consumers prioritize in the current environment.

The past year has underscored the heterogeneous nature of e-commerce. To grasp the annual development accurately, it's increasingly crucial to comprehend the nuances within each sub-sector, a trend expected to persist throughout 2024.

Growing differences in the development of the industries

Throughout 2023, the E-barometer's development figures depicted a fragmented landscape. Performance varied significantly, with figures spanning a range of 36 percentage points, showcasing both clear winners and losers.

On one end of the spectrum, cyclically sensitive industries like construction faced a challenging year with a development of minus 19 percent. Conversely, the pharmacy trade emerged as a success story, boasting a remarkable 17 percent growth. This shift towards certain industries contributed to the positive outcome. Additionally, the pharmacy trade effectively retained consumers who transitioned to online shopping during the pandemic.

These industry examples reflect the varied landscape of 2023's development, with some sectors thriving, others struggling, and some maintaining stability amidst numerous challenges. As of now, there are no indications that industry developments will converge in the near future. Industries like pharmacy are projected to continue growing, while capital-intensive sectors are expected to grapple with ongoing economic challenges.